Ultimate MAM platform

Attract the best traders and money managers with a feature-rich MAM platform

What is a MAM platform?

MAM managers are the most valuable asset your brokerage can have as they always have their own pool of investors. Our platform can help you meet the needs and requirements of the most sophisticated money managers. Once they come to you, they will bring all their investors to your company!

Features your money managers are used to

Proportionally by free margin

Proportionally by equity

Lot allocation (ratio multiplier)

Proportionally by balance

Fixed lot allocation

PAMM (without reallocation)

PAMM (with autocorrection)

PAMM (with reallocation of positions)

Proportionally by equity x multiplier

Proportionally by balance x multiplier

Money managers sometimes work with clients who have different risk tolerances. In this case, MAM masters can deactivate investors and allow them to skip some positions without unsubscribing them.

Activation and deactivation does not close opened positions.

Open new opportunities for your money managers

Master Account 1

Investor 1

Investor 2

Master Account 2

Allow your clients to divide different trading strategies amongst several accounts. Making manual trades in MetaTrader when you have 30-100 and more opened positions is not easy!

Allow your clients to use one account for EAs and a second account for personal trading.

Master Account

Investment account

Investment account

Investment account

Your clients can use an account nominated in any currency. The platform supports any combination imaginable. All fees will be calculated and paid respectively.

Accounts can be opened in fiat and cryptos: USD, JPY, BTC, USDT, EUR, etc.

Master in BTC and Slave in ETH

Master in USD and Slave in Ripple

Master in USDT and Slave in GBP

Your clients can be placed in different groups with different symbol names for one instrument where you can set different price streams and other symbol settings.

Manual mapping for other symbols

Auto-mapping of symbols for FX and Metals

Different price streams for Master and Slaves

Our platform by default has a leaderboard of master accounts. However, your money managers have the option to show or hide accounts from the leaderboard.

Allow your biggest IBs to run their pool of clients in a separate web-interface. In this way, they will be able to have multiple master accounts and promote them without interfering with other clients’ accounts that are not under their IB schema.

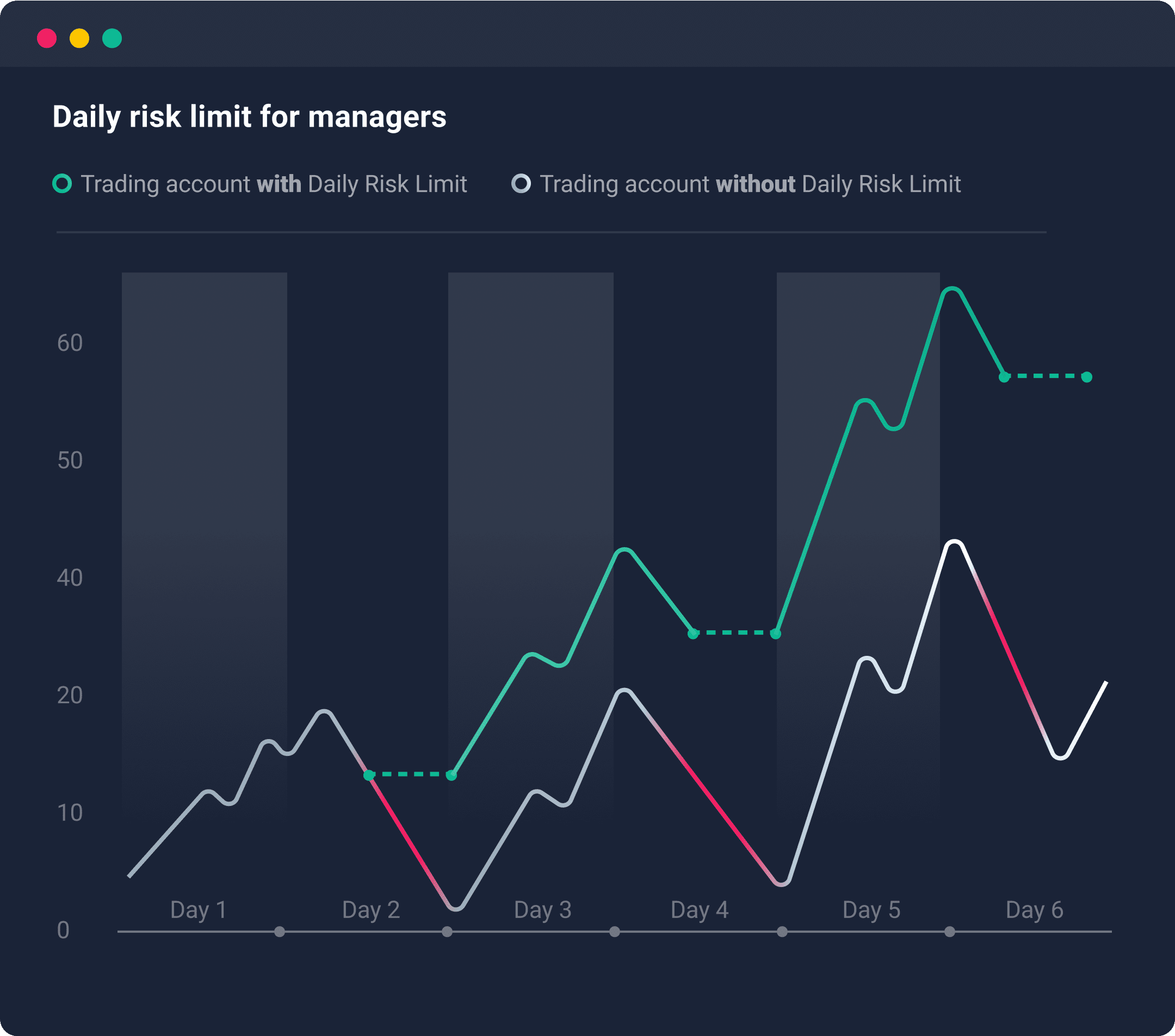

Bad days can happen with every trader. The aim is to avoid leaving all money on the table due to a single mistake. Offer your clients a daily risk limit – a tool widely used by all investment funds.

It’s simple – all the trader needs to do is set the percentage to equity at the beginning of the day. If the trader reaches it, the platform blocks all trading until the next day.

Risk control is what makes the difference between active and passive investments.

With our platform, your clients can set a risk limit for their investments and feel safe and calm. A less stressful experience will earn the trust of your clients.

Less stress, more trust

Four types of fees all paid automatically

Four types of fees are available within the investment platform. Each are designed to pay money managers for their efforts and are transferred from the investment account to a trader’s wallet.

Features your money managers are used to

10 Allocation methods

- Proportionally by free margin

- Proportionally by equity

- Lot allocation (ratio multiplier)

- Proportionally by balance

- Fixed lot allocation

- PAMM (without reallocation)

- PAMM (with autocorrection)

- PAMM (with reallocation of positions)

- Proportionally by equity x multiplier

- Proportionally by balance x multiplier

Activation-Deactivation

Money managers sometimes work with clients who have different risk tolerances. In this case, MAM masters can deactivate investors and allow them to skip some positions without unsubscribing them.

Activation and deactivation does not close opened positions.

Open new opportunities for your money managers

Several master accounts for managing a pool of investors

Allow your clients to divide different trading strategies amongst several accounts. Making manual trades in MetaTrader when you have 30-100 and more opened positions is not easy!

Allow your clients to use one account for EAs and a second account for personal trading.

All Fiat and Cryptocurrencies are supported

Your clients can use an account nominated in any currency. The platform supports any combination imaginable. All fees will be calculated and paid respectively.

Accounts can be opened in fiat and cryptos: USD, JPY, BTC, USDT, EUR, etc.

- Master in BTC and Slave in ETH

- Master in USD and Slave in Ripple

- Master in USDT and Slave in GBP

Four types of fees all paid automatically

Subscription fee

The simplest type of fee. Just one flat fee regardless of account size, trading frequency or profit. USD only.

Can be paid daily / weekly / monthly

Performance fee

Management fee

Volume fee

General comparison of account types

| Features | Copy Trading | PAMM | MAM | Comment |

|---|---|---|---|---|

| Money managers appear in leaderboard | optional | optional | optional | No sense in providing opportunity for MAM master to show his performance in the leaderboard because the master can activate /deactivate the investor and use different formulas for copying trades to the investment account. |

| Investors can subscribe to money managers on their own | optional | optional | optional | Any master account can be hidden from the leaderboard. |

| Investors can see opened positions in MT5 | Investors of PAMM accounts only get balance operations on investment accounts with their share of PnL of positions opened on the master account. | |||

| Investors get exact same return as money manager | Because MAM and Social Trading are based on copy-trading, execution prices on investors and the master can be slightly different. | |||

| Deposit/Withdrawal on investment account affects equity of Master account | The PAMM-master account is combined from several investment accounts, which is why when you deposit money on a PAMM investment account, the same amount will be deposited to the PAMM Master. In MAM and Copy investment accounts are separated from master accounts. | |||

| Instant Deposits/Withdrawals | optional | Deposits/Withdrawals in PAMM accounts are usually made with scheduled rollovers so they will not be a surprise for money managers. It is however possible to set them in “Immediate” mode. | ||

| Subscriptions and unsubscriptions are immediate | optional | |||

| Investor can trade on investment account | MAM and PAMM investment accounts are in “Read-Only” Mode. | |||

| Investor can close position that was opened by a master |

Launch MAM Trading Platform